Call Us :8615298359310

Call Us :8615298359310

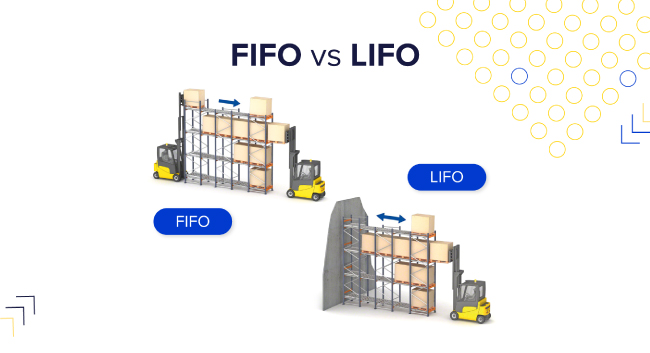

Inventory valuation could positively contribute a fine decision-making in inventory management which conspires to be beneficial for a company's net income, tax liability, and overall financial health. Two common methods for inventory valuation are FIFO (First-In, First-Out) and LIFO (Last-In, First-Out). Understanding these methods and their implications is essential for accurate financial analysis and strategic decision-making.

Inventory management is a fundamental part of any business dealing with physical goods. The method a company chooses to value its inventory can have profound effects on its financial statements or even tax obligations. FIFO and LIFO are the two primary methods of inventory valuation used by companies. Each has its own set of advantages and disadvantages, impacting the return of investment differently. This article will help you analyze the features of each method, compare their impacts, and discuss their pros and cons.

Inventory represents a company's goods in various stages of production, including raw materials, work-in-progress, and finished goods ready for sale. Accurate inventory valuation is vital because it influences the company's balance sheet, cost of goods sold (COGS), and net income. Inventory is considered an asset, and its valuation must reflect its true worth to ensure the company’s financial statements are accurate.

1. Raw Materials: Basic goods used in the production process to generate finished products.

2. Work-in-Progress: Items that are in the process of being manufactured but are not yet complete.

3. Finished Goods: Products that are ready for sale and delivery to consumers.

Inventory accounting assigns values to the goods in each stage and classifies them as company assets. Proper valuation ensures that the company’s financial health is accurately represented. The basic formula for calculating inventory is: Beginning Inventory (BI)+Net Purchases−Cost of Goods Sold (COGS)=Ending Inventory (EI)\text{Beginning Inventory (BI)} + \text{Net Purchases} - \text{Cost of Goods Sold (COGS)} = \text{Ending Inventory (EI)}Beginning Inventory (BI)+Net Purchases−Cost of Goods Sold (COGS)=Ending Inventory (EI)

The FIFO method assumes that the oldest inventory items are sold first. This approach aligns well with the natural flow of inventory, as companies typically use their oldest stock first to prevent obsolescence. For example, in a bakery, the bread baked first is sold first, ensuring that the freshest inventory remains. FIFO is logical and often results in higher net income and higher inventory values on the balance sheet during periods of rising prices.

Example: Consider a bakery that produces 200 loaves of bread on Monday at a cost of $1 each and another 200 loaves on Tuesday at $1.25 each. If the bakery sells 200 loaves on Wednesday, under FIFO, the COGS would be $1 per loaf because the first produced loaves are sold first. The $1.25 loaves remain in ending inventory.

Conversely, the LIFO method assumes that the newest inventory items are sold first. This method can be advantageous in times of inflation, as it matches the most recent, higher costs with current revenues, thereby reducing taxable income. However, LIFO can lead to outdated inventory values on the balance sheet, as older, potentially obsolete stock remains recorded at lower historical costs.

Example: Using the same bakery example, if the bakery sells 200 loaves on Wednesday, under LIFO, the COGS would be $1.25 per loaf because the most recently produced loaves are sold first. The $1 loaves remain in ending inventory.

Advantages of LIFO:

Disadvantages of LIFO:

In an inflationary environment, FIFO and LIFO have distinct impacts on a company’s financial statements. FIFO results in lower COGS because older, cheaper inventory is used first, leading to higher net income and higher taxes. In contrast, LIFO results in higher COGS as newer, more expensive inventory is sold first, leading to lower net income and reduced tax liability. This difference can significantly affect a company’s financial health and tax strategy.

· FIFO:

· LIFO:

FIFO Pros:

FIFO Cons:

LIFO Pros:

LIFO Cons:

Example of Impact During Inflation: Assume a company purchases 1,000 units of inventory at $10 each in January and another 1,000 units at $15 each in June. By December, the company sells 1,000 units at $20 each.

· FIFO:

· LIFO:

In this example, FIFO results in higher net income and ending inventory values, while LIFO results in lower net income and ending inventory values, illustrating the tax benefits of LIFO during inflation.

1. Is FIFO better than LIFO?

FIFO is often better for companies seeking higher net income and inventory values, but it can result in higher taxes. LIFO can reduce tax liability but may not reflect current inventory values accurately.

2. Can companies switch between FIFO and LIFO?

Companies can switch inventory methods, but they must follow regulatory guidelines and disclose the change in their financial statements. Changing methods can have significant tax and financial reporting implications, so it is typically done under strategic circumstances.

3. Why is LIFO not allowed under IFRS?

LIFO is not allowed under IFRS because it can distort inventory values and does not align with the fair value principle. IFRS emphasizes transparency and comparability in financial reporting, and LIFO’s potential for outdated inventory valuations conflicts with these goals.

4. Which industries typically use FIFO?

Industries dealing with perishable goods, such as food and pharmaceuticals, typically use FIFO to ensure the oldest inventory is sold first. This method helps prevent spoilage and ensures that inventory values reflect more current costs.

5. How does inventory valuation affect net income?

Inventory valuation directly impacts COGS, which in turn affects net income. FIFO usually results in higher net income, while LIFO results in lower net income during inflationary periods. Accurate inventory valuation is crucial for understanding a company’s profitability and financial health.

Both methods have their advantages and disadvantages, and the choice largely depends on the company’s specific circumstances, such as the nature of their inventory and economic conditions. Whether using FIFO or LIFO, companies must carefully consider their inventory valuation method and its implications for their business operations.

If you would like to know more about our industrial storage solution to those two different inventory management methods, inquire now with our experts in warehouse storage and get your free warehouse planning consultation.

Copyright © 2024 Jiangsu VISON Logistics Technology Co., Ltd. All Rights Reserved.  Network Supported

Network Supported

Sitemap | Blog | Xml | Privacy Policy